Colorado Job Creation & Main Street Revitalization Act

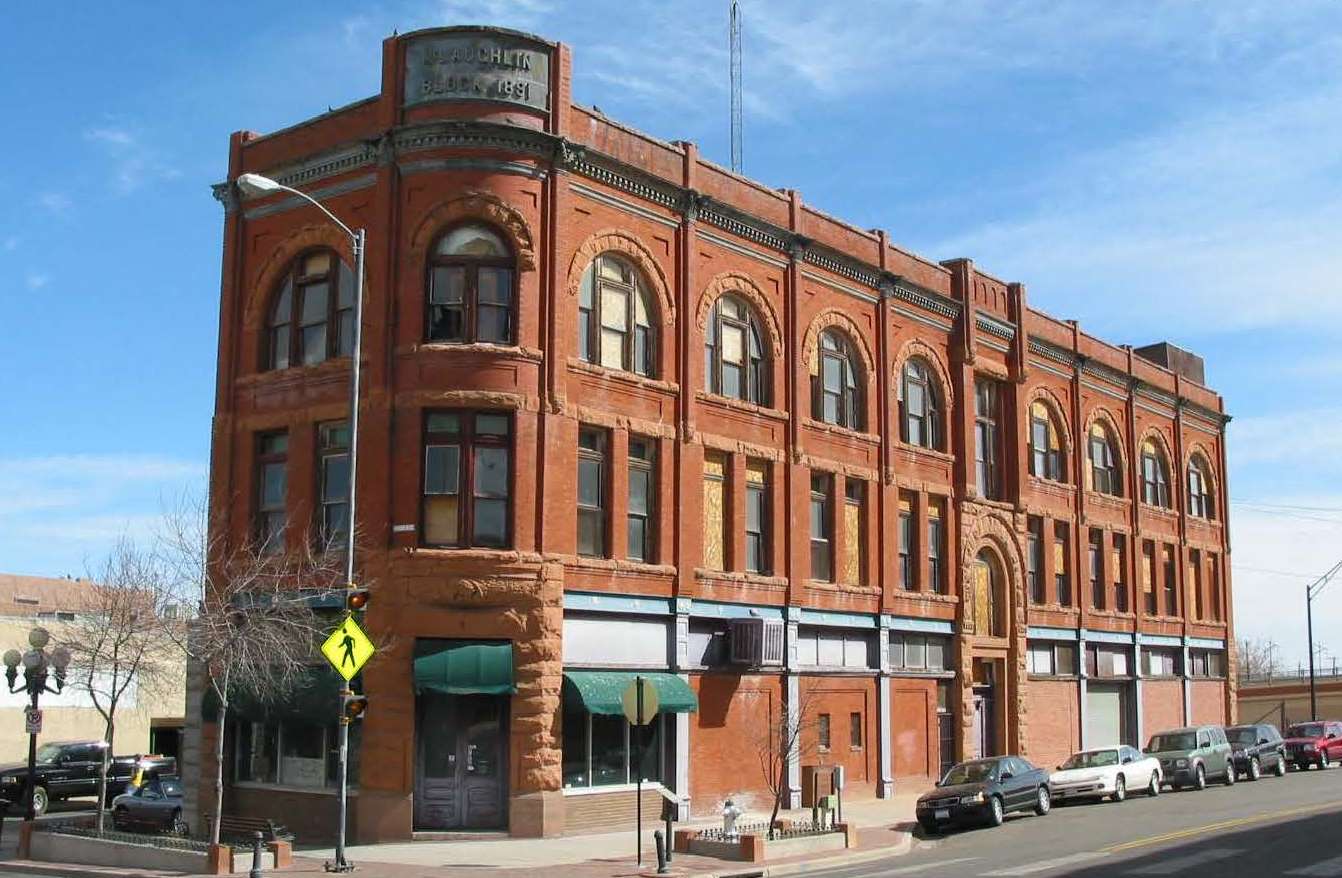

Many of Colorado’s traditional main streets have been at a tipping point. Many buildings are vacant, their historic facades in decay and their local economies in desperate need of investment and revitalization. Colorado was one of the first states to create a Historic Preservation Tax Credit in 1990, but a significant need to improve this tax credit was identified in 2014. This new tax credit allows Colorado to remain competitive with neighboring states while providing better benefits that can be used to attract critical commercial reinvestment, rehabilitation and revitalization of main streets across our state.

The improved tax credit is modeled after successful, bipartisan legislation passed in other states that provide critical incentives to get languishing buildings back into viable use, while simultaneously spurring tremendous economic growth, job creation and historic preservation in rural and metro areas.

Who Benefits?

- Cities and towns across Colorado – especially those damaged in recent disasters – seeking to create new jobs, reactivate historic buildings with new businesses, add housing, preserve their cultural heritage and attract tourism

- Local leaders who need their property values and tax revenues to rise to pay for local services

- Property owners who can’t afford to rehabilitate store fronts or bring their property up to code

- Small businesses & non-profits seeking an attractive and convenient space to start or expand their operations

- The State of Colorado by spurring economic growth and tax revenue from new jobs and tourism

How the Bill Works:

The bill is modeled after successful bipartisan legislation in other states and establishes two eligibility pools for the commercial tax credit, one pool for smaller projects and one for larger projects. The tax credit does not go into effect until FY16-17 and the total amount of tax credits is capped at $5 million in FY16-17 and capped at $10M each year for years FY17-20 and then sunset. Although many states do not have any caps, this program allows Colorado to begin competing with other states.

- Small Historic Rehabilitation Projects: One pool is set aside for smaller historic preservation projects with Qualified Rehabilitation Expenses (QREs) of less than $2 million.

- Minimum expenditure to equal 25% of original purchase price, less land value

- All projects must be certified by the State Historic Preservation Office

- Projects below $2M of QREs will receive a 25% state tax credit. All credits are transferable and can be taken directly by the property owner or transferred to a financial partner who provides funds for rehabilitation work

- Projects located in state and/or federal disaster designations will qualify for an additional state tax credit of 5% of QREs if placed in service up to 8 years following such designation.

- Large Historic Rehabilitation Projects: The second pool is set aside for larger historic commercial projects with significant capital investment with projected QREs in excess of $2 million.

- All projects must be certified by the State Historic Preservation Office

- Minimum expenditure to equal 25% of original purchase price, less land value

- These projects will receive a 20% state tax credit for all QREs and credits are transferable with a maximum tax credit per of $1 million.

- Large projects located in state and/or federal disaster designations will qualify for a state tax credit of 25% of QREs if placed in service up to 8 years following such designation.

- Strict Safeguards with Predictable Funding Structure:

- The program is strictly structured so that the State approves applications up front but no tax credit is realized until projects are completed and all construction investments have been made.

- Only rehabilitation projects that begin on or after 7/1/15 are eligible for the tax credit and no credit will be issued until FY16.

- Only properties designated historic at the local, state or national level are eligible and a minimum expenditure is required equal to 25% of the original purchase price of the property.

- Third party audits are required on projects with anticipated tax credits over $250k

- A report will be made to the General Assembly in FY17 regarding the program’s impact on job creation and economic development.

Helpful Links:

More About the Colorado State Tax Credit

A BIG thank you to all of our partners for getting this bill passed!