The Colorado Job Creation &

Main Street Revitalization Act

In 2014, the state of Colorado enacted the Colorado Job Creation and Main Street Revitalization Act, bringing an enhanced state historic preservation tax credit to all Colorado communities. The program has been overwhelmingly successful since its launch in July 2015. Since that time, tax credit recipients have used this credit to kick-start 37-commercial projects across the state totaling more than $121 million, while residential tax credit projects have allowed homeowners to repair and maintain their historic residences.

On May 30, 2018 Governor Hickenlooper signed HB1190, a bipartisan bill that extends the Job Creation Main Street Revitalization Act into 2029. The Historic Preservation Tax Credit was established in 2014 and set the credit at $10 million annually with $5 million for small projects and $5 million for large projects. The credit spurs investment in communities throughout the state and since the program went into effect recipients have used them to kick start 52 commercial projects statewide. These projects have led to over 800 full-time jobs, generating $17.9 million in income for property owners, bringing in $13.2 million in total sales tax.

The 2018 reauthorization effort included:

- Continuing the credit at $10 million annually, with $5 million for small projects and $5 million for larger projects.

- Additional incentives (35% credit) for projects in rural areas.

- Adjustments to current qualifiers for the program to remove obstacles for small projects such as adjusting the lease requirement for rural projects and replacing a complicated formula to determine ‘qualified rehabilitation expenditures’ with a flat amount.

- Separating the residential and commercial tax credit in statute to provide clarity to taxpayers about the specific rules for each

- Technical program changes to increase efficiency and reduce the cost of the program

Why the Tax Credit is Important

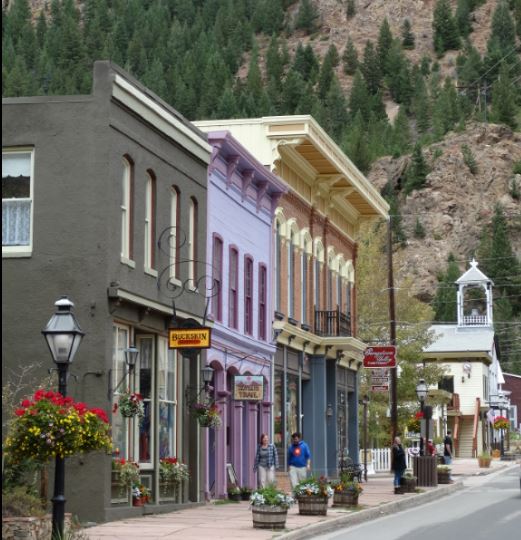

The credit is aimed at spurring investment in communities throughout the state with a specific emphasis on rural communities. The program has been overwhelmingly successful since its launch, the projects represent a geographic diversity that includes the communities of Silverton, New Castle, Trinidad, Telluride, Steamboat Springs, and several across the Front Range metropolitan area.

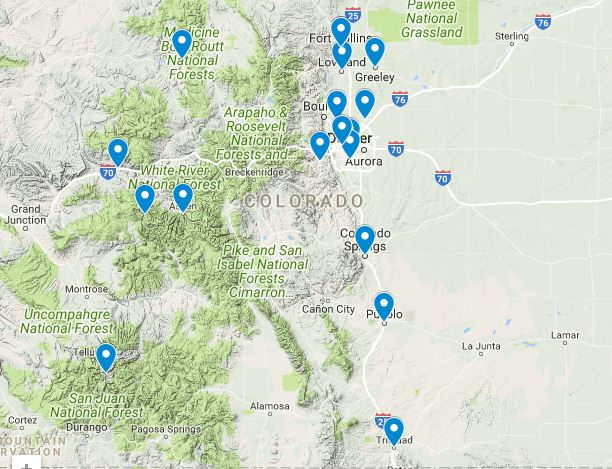

Communities with current tax credit projects (as of August 2017)

Tax credit projects will yield more than $9.5 million in direct sales tax for the state and project applicants estimate that 661 new full-time jobs will be created as a result of the economic development generated by these projects. Counting all full and part-time jobs, project applicants estimate they will increase payroll by $31 million once their projects are completed.

In addition to these benefits, the tax credit has provided the ideal opportunity to incentivize a revitalization of Main Streets throughout the state.

The net gain for property owners is a rise in property values of more than $194 million and again in income by at least $19 million.

Please click here if you are interested in learning more about the success of the Colorado Job Creation and Main Street Revitalization Act.

Find Out More

- Learn more and read HB18-1190: Modify Job Creation Main Street Revitalization Act

- View HB14-1311: Colorado Job Creation and Main Street Revitalization Act

- OEDIT: Information on the application process

- History Colorado: Send project questions to Joseph Saldibar, 303-866-2741, [email protected]

- Historic Denver: Project questions and information on the credits.

- Tax Credit Connection, Inc.: Interested in selling your credits